Market and business update - March 2022

The shipping and ship supply industries are characterized by uncertain market conditions and volatility in line with most industries in the world market. The head winds of COVID-19 and the Russian invasion of Ukraine have a radical inflationary impact on commodity prices and general market conditions.

This market and business update intends to give you an overview of expected price increases within the most important commodities, freight rates, supply chain challenges, and the additional effects of labor shortages, increased lead times, and delays in major ports.

The shipping industry still suffers from considerable wait times, congestion and delays for ships headed into main ports across the world. The world trade continues to drive up the demand for containers, while at the same time experiencing a reduced container capacity.

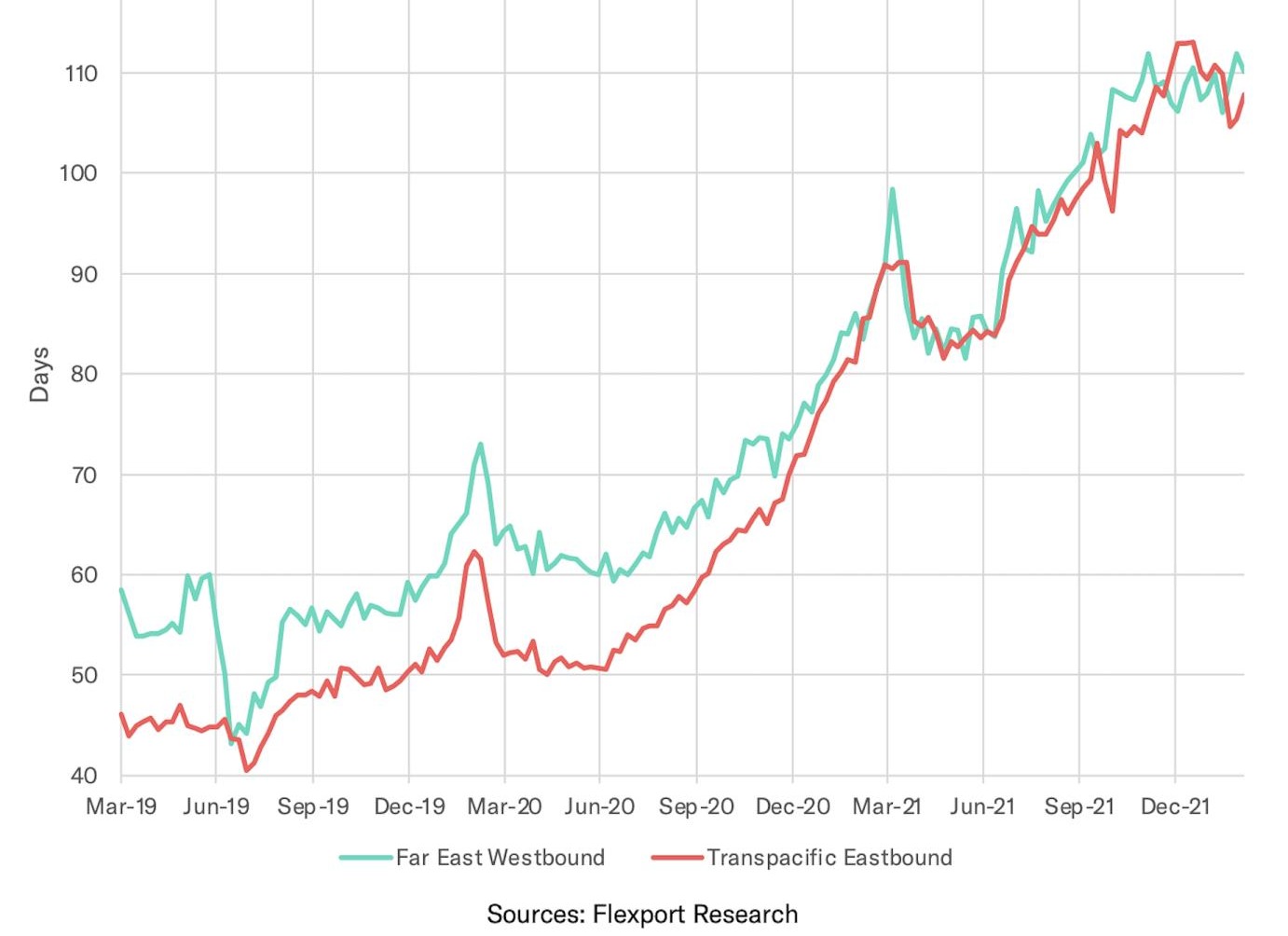

The recent report by Flexport Research shows the impact on lead time on the two biggest trade lanes: The Transpacific Eastbound (TPEB) and Far East Westbound (FEWB).

• March 2020: 50 days

• March 2021: 90 days

• March 2022: 108 days

• March 2020: 65 days

• March 2021: 98 days

• March 2022: 110 days

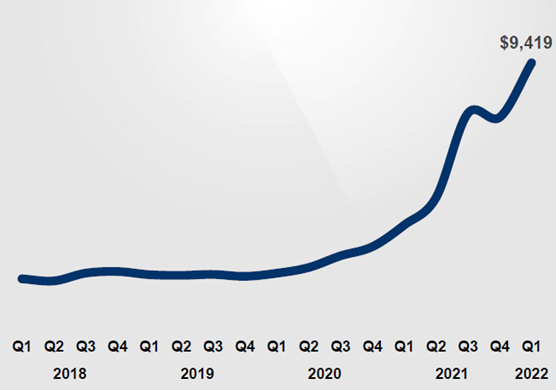

Freight rates are likely to remain elevated through 2022 due to rising fuel prices and congestion in supply chain. According to the Drewry World Container Index, the container price index reached its highest level in Q1 2022. The costs of air freight have also increased due to less capacity, different routing, and rising fuel prices.

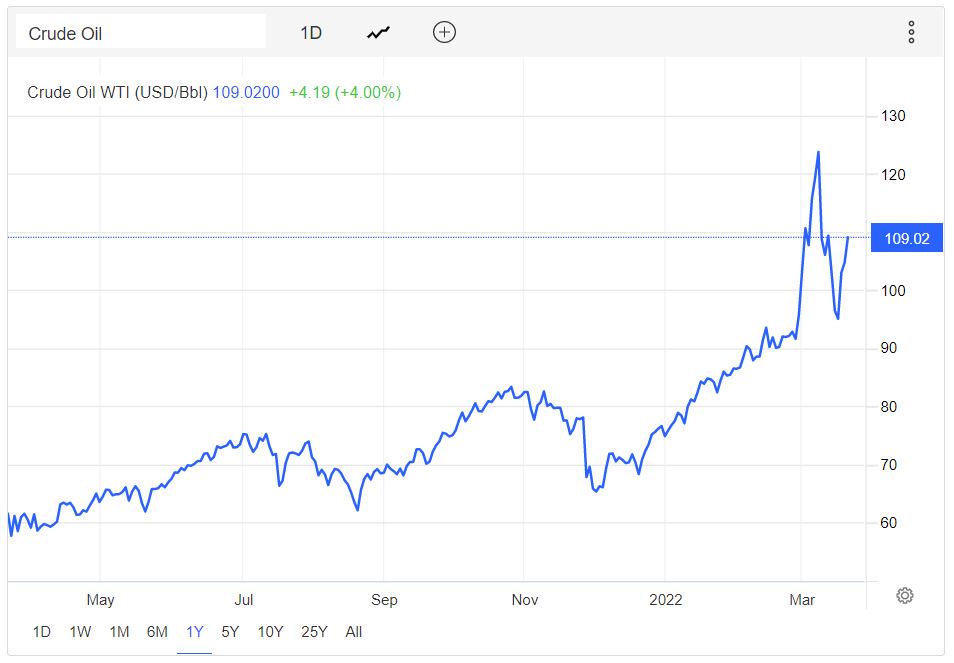

The crude oil prices driven by Russia’s invasion of Ukraine, sanctions on Russia and tight market conditions

have increased to historic heights. High energy prices are passed over to industries and consumers, and

thus contribute to increased costs of virtually all commodities further fueling inflation expectations. The price increase in crude oil is reflected in this table by Trading Economics Index.

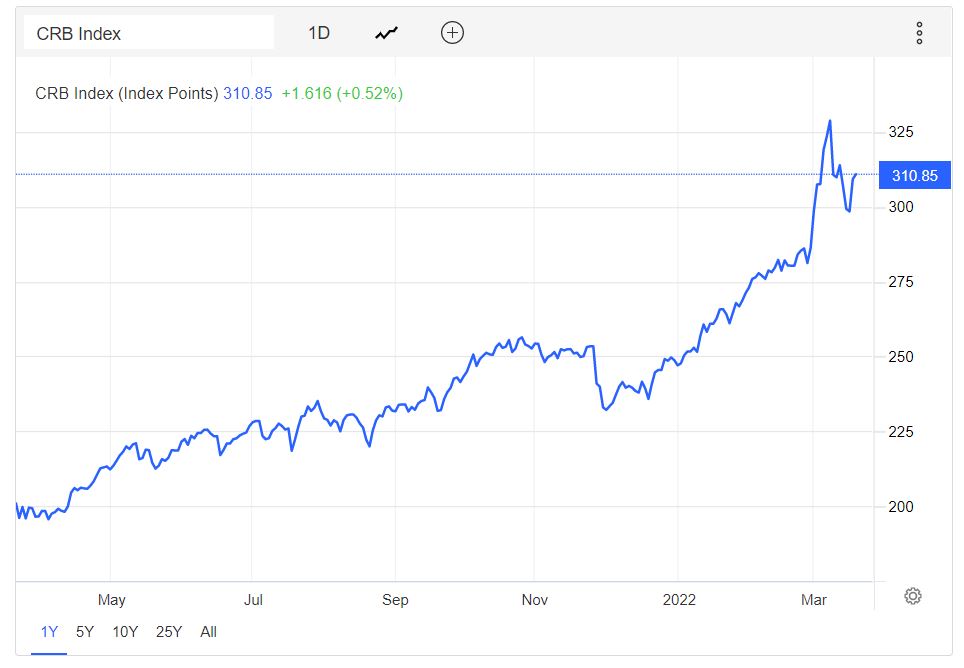

According to the CRB Index, the commodity prices are on the rise, elevating also the price level of provisions and stores.

On short term, we do not foresee any major shortages on provisions as our existing contracts are still honored by our suppliers, giving high priority to large customers. However, this situation might change any time due to volatility. We are continuously investigating alternative suppliers as supply might get under pressure at longer term. Recently, several suppliers have invoked Force Majeure to exempt themselves from their contractual obligations, increasing prices with immediate or two weeks effect.

In 2022, food prices are predicted to increase between 5-6%, according to the FAO Food Price Index. Food prices leveraged 3.9% from January 2022 to March 4, 2022, and this represents a new all-time high level, exceeding the previous top of February 2011.

Due to the inflationary effects and predicted food price increases, we expect the prices of the following provision categories to increase significantly on short term. The list is not exhaustive. We will of course try to limit the price increases, but you should expect extraordinary price increases for the following products.

On short term, we do not foresee any shortages on technical consumables and stores. However, this situation might change any time due to volatility

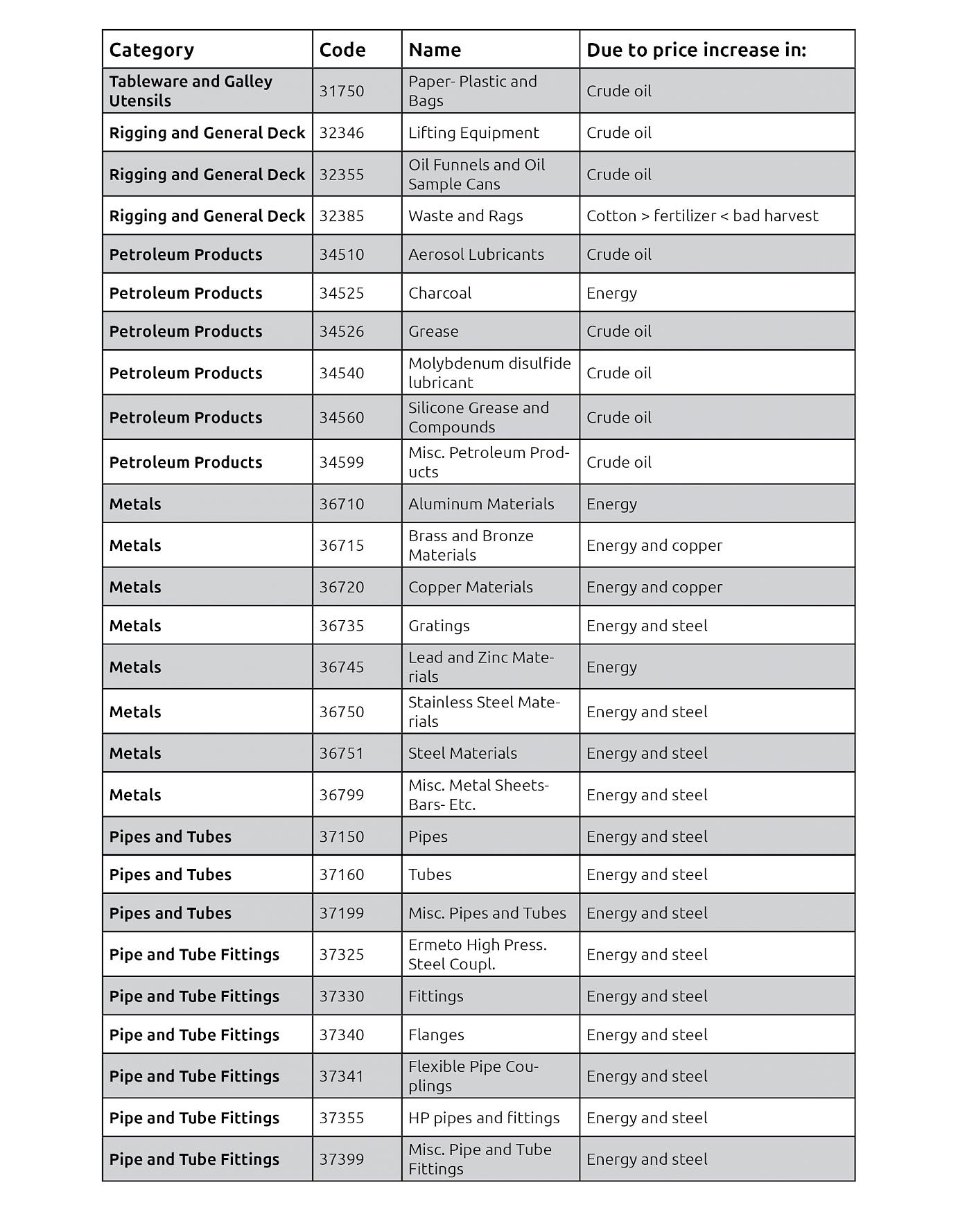

The significant rise in oil and gas prices are feeding through into higher inflation, effecting raw materials, transport costs, energy costs and production costs. Due to the inflationary effects, we expect the prices of the following stores categories to increase significantly on short term. The list is not exhaustive.

We will of course try to limit the price increases, but you should expect extraordinary price increases for the following products.

Inflationary and other macro impacts on major ports

Inflationary and other macro impacts on major ports| WNA overall |

|

| Seattle |

|

| Long Beach/West Coast |

|

| East Coast |

|

| US Gulf |

|

| Canada |

|

| Rotterdam |

|

| Algeciras and other Spanish ports |

|

| Singapore |

|

| Dubai |

|